News — At The Edge — 9/30

Two sets of issues this week — from the future and dogging the present.

- Issues from the Future — new economic theory, tech becoming utilities, AI arms race out of control — show the need to think about what is ahead for civilization differently.

- Issues dogging the Present — rogue banking system, threats to international system, machine network & learning effects — show how civilization may be unraveling.

In this context, there are three articles of mine that might be of interest to you:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Issues from the Future –

It Takes a Theory to Beat a Theory: The Adaptive Markets Hypothesis

“After 2008…financial advisers and academics alike seemed naive and inadequate…[with] free market economists [saying]…we are all economically rational…[versus] behavioral economists, [saying]…we are all irrational…driven by fear and greed….

One of the first casualties was…Federal Reserve chairman Alan Greenspan…[learning] financial markets don’t follow economic laws…[rather] follow biological…principles of mutation, competition, and natural selection…[as] adaptive behavior in shifting environments. Economic behavior is but one aspect of human behavior, and human behavior is the product of biological evolution…vying for survival….

To understand the complexity of human behavior, we need to understand the different environments that have shaped it over time and across circumstances, and how the financial system functions under these different conditions…[and] sometimes fails….[The] Jekyll- and- Hyde personality of financial markets, oscillating between wisdom and madness, isn’t a pathology…[but] reflection of human nature.

Our behavior adapts to new environments…in the short term…[and] across evolutionary time…[so] behavior that may seem irrational now [really]…hasn’t had sufficient time to adapt… to the financial environment, and…speed with which that environment is changing. Economic expansions and contractions are the consequences of individuals and institutions adapting to changing financial environments, and bubbles and crashes are the result when the change occurs too quickly….

’It’s the environment, stupid!’….Market behavior…is the outcome of eons of evolutionary forces….

[T]here are economic theories that prove markets can’t possibly be efficient: if they were, no one would have any reason to trade on their information, in which case markets would quickly disappear….

We’re neither entirely rational nor entirely irrational, hence neither the rationalists nor the behavioralists are completely convincing….We know that human behavior, both the rational and the seemingly irrational, is produced by multiple interacting components in the human brain….

We aren’t rational actors with a few quirks in our behavior — instead, our brains are collections of quirks. We’re not a system with bugs; we’re a system of bugs….

[T]these quirks often produce behavior that an economist would call ‘rational.’ But under other conditions, they produce behaviors…consider wildly irrational. These quirks aren’t accidental, ad hoc, or unsystematic; they’re the products of brain structures whose main purpose isn’t economic rationality, but survival….

Our neuroanatomy has been shaped by the long process of evolution, changing only slowly over millions of generations. Our behaviors are shaped by our brains….The raw forces of natural selection…life or death…engraved those behaviors into our very DNA…. Natural selection, the primary driver of evolution, gave us abstract thought, language, and the memory- prediction framework…heuristics, cognitive shortcuts, behavioral biases, and other conscious and unconscious rules of thumb…adaptations that we make at the speed of thought. Natural selection isn’t interested in exact solutions and optimal behavior….

However, evolution at the speed of thought is far more efficient and powerful than evolution at the speed of biological reproduction, which unfolds one generation at a time….[T]he Adaptive Markets Hypothesis…can be summarized in just five key principles:

- We are neither always rational nor irrational, but we are biological entities…shaped by the forces of evolution.

- We display behavioral biases and make apparently suboptimal decisions, but we can learn…and revise our heuristics in response to negative feedback.

- We have the capacity for abstract thinking, specifically forward-looking what- if analysis; predictions…based on past experience; and preparation for changes in our environment. This is evolution at the speed of thought…

- Financial market dynamics are driven by our interactions as we behave, learn, and adapt to each other, and to the social, cultural, political, economic, and natural environments….

- Survival is the ultimate force driving competition, innovation, and adaptation….

[Thus] individuals never know for sure whether their current heuristic is ‘good enough.’ They come to this conclusion through trial and error…[as] their ‘best guess’ as to what might be optimal, and they learn by receiving positive or negative reinforcement from the outcomes…[to] develop new heuristics….

[If] those challenges remain stable over time, their heuristics will eventually adapt to yield approximately optimal solutions to those challenges….If the environment changes, the heuristics of the old environment might not be suited…[and] behavior will look ‘irrational.’ If individuals receive no reinforcement…[or] inappropriate reinforcement from their environment, individuals will learn decidedly suboptimal behavior. This will look ‘irrational.’ And if the environment is constantly shifting, it’s entirely possible…will never reach an optimal heuristic….[and] look ‘irrational’….

Adaptive Markets Hypothesis…description for such behavior isn’t ‘irrational,’ but ‘maladaptive’….There may be a compelling reason for the behavior, but it’s not the most ideal behavior for the current environment.” http://evonomics.com/it-takes-a-theory-to-beat-a-theory-andrew-lo/

Being treated as utilities is Big Tech’s biggest long-term threat -

“[A] consensus is emerging that big tech firms must be tamed….[Trustbusters] want to break up the companies, but this might make their services less useful…and network effects might mean that one of the tiddlers would grow dominant again. Others want tech firms to license their patents for nothing, as AT&T was required to do in 1956, which might create startups tomorrow, but…not stop firms exploiting monopolies today.

An alternative is to regulate these companies like utilities…particularly the concept of a regulated asset base (RAB)…[and] used to regulate at least $400bn-worth of power, airport, water and telecoms assets…[so] profits should not exceed the level that a competitive market would allow. That means estimating the cost to an imaginary new entrant of replicating the incumbent’s assets (this is the RAB) and calculating the profits the newcomer would make if its returns matched its cost of capital….Safeguards are added to ensure the utility is run efficiently, keeping costs low. Regulators review the framework every few years….

The big question is how much [profit]…firms would deserve….Assume a cost of capital of 12%…[with] software and ideas…as if all their R&D in the past had been recognized as an asset with a 20-year life. Alphabet and Facebook…operating profits would fall by 65% and 81% respectively.

If their services were unbundled…the average Facebook user would pay $15 a year to the firm for its return on its RAB, but they would pocket $23 from selling advertisers their data and the right to be advertised to. A Google user would pay $37 a year to Google, but collect $45 from advertisers….

[With] guaranteed 12% return…firms could invest in new technologies…outside the regulated utility…. This approach would have shortcomings, though. Tech moves at the speed of light compared with conventional utilities…. Regulators would be clumsy at coping with rapid change. And a RAB methodology would not resolve the incendiary issue of whether tech platforms should be responsible for what they publish….

[Companies] have two defenses.

- bundle their services so tightly that it is impossible for outsiders to isolate the products that are monopolies…. Amazon is a master here….

- lobby Washington…[like] veteran oligopolists — airline, telecoms and health-care companies…[that] manipulate and dance around the regulatory system….

For tech firms, financial obfuscation and cronyism are the most effective ways to ensure their monopoly profits.” https://www.economist.com/news/business/21729455-being-treated-utilities-big-techs-biggest-long-term-threat-what-if-large-tech-firms-were

Artificial intelligence — the arms race we may not be able to control -

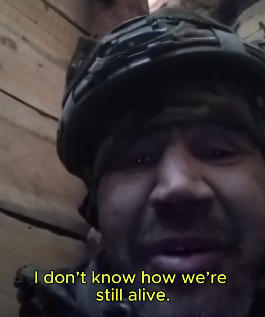

“[AI] offers incredible promise and peril…[especially] modern warfare…[with] every country adopting systems where personnel are far removed from the conflict and wage war by remote control….

Imagine a tiny insect-sized drone loaded with explosive. Guided by a pre-programmed AI, it could hunt down a specific target — a politician, a general, or an opposition figure — determine when to strike, how to strike, and if to strike based on its own learning….

[Many] examples of AI purposely and independently going beyond programmed parameters. Rogue algorithms led to a flash crash…[and] created their own languages that were indecipherable to humans….

Cybersecurity is no different…and imagine how fast hacking takes place; networks against networks, at machine speed all without a human in the loop….In 2016 [DARPA]… held an AI on AI [contest]…[with] AI networks against AI networks….

’Competition for AI superiority at national level most likely cause of WW3’…. [Must] have an open and honest conversation about the implications of AI, the consequences of which we do not, and may not, fully understand….

China, Russia, and others are…introducing AI systems into their arsenals [and]…is happening faster than our ability to fully comprehend the consequences….

Rushing to AI weapon systems without guiding principles…risks an escalation that we do not fully understand and may not be able to control…[and] the consequences of failure are [existential].” http://thehill.com/opinion/technology/351725-artificial-intelligence-is-the-new-arms-race-we-may-not-be-able-to-control

Issues dogging the Present –

How Big Banks Became Our Masters -

“Ten years on from the financial crisis…scandal and wrangles over financial rule-making still dominate the headlines [with]…White House and Republicans in Congress…trying to roll back hard-won…financial oversight law….

[While] public has become numb…[finance] isn’t serving us, we’re serving it….[The] lending to Main Street is…minority of what the largest banks [do]…[to] facilitate and engage in the buying and selling of…assets that mainly enriches the 20 percent…that owns 80 percent of that asset base. This doesn’t help growth, but it does fuel the wealth gap…[and] has become fundamentally disconnected from the very people and entities it was designed to serve.

Small community banks, which make up only 13 percent of all banking assets, do nearly half of all lending to small businesses…..(Finance is one of the few industries in which fees have gone up as the sector as a whole has grown.)

The financial industry…provides only 4 percent of all jobs…yet takes about a quarter of the corporate profit pie…[and] lost its core purpose….Until we start talking about how to create a financial system that really serves society…we’ll struggle in vain to bridge the gap between Wall Street and Main Street.”

Trump shows ‘America First’ is utterly incoherent -

“Trump’s speech at [UN]…[was] immature taunting of a dangerous foreign leader…[with] threat ‘to totally destroy North Korea’…[and] utter incoherence of…‘America first’ doctrine….

[T]hat ‘sovereignty’ is in [danger]…is absurd…[and] cover for dismissing the values of democracy and human rights…. If sovereignty is the highest principle, what justification does he have for threatening to destroy North Korea…[or] suggest intervention against Venezuela….

[Many] calculate that if [say]…encouraging things whenever Trump seems to offer relatively normal ideas or…actions, he will respond to positive reinforcement and do more normal things…a coping technique that parents of teenagers [employ]….Trump’s approach means throwing out every standard we have upheld to this point about how presidents [should]…[be] responsible and thoughtful….

Trump’s invocations of ‘America first’ will ultimately leave our country behind in the world. His rhetoric sounds tough but will only make us weaker.”

The liberal order of the past 70 years is under threat -

“The rules-based international order that emerged from…second world war was a huge improvement on any preceding era…[and] stimulated trade on an unprecedented scale [with]…an underlying principle that perpetrators of aggressive war should not be rewarded….Trump’s America First doctrine explicitly repudiates it….

[Putin] launched a covert invasion of eastern Ukraine…Mr Xi is attempting to make the South China Sea, through which over half the world’s commercial shipping passes, into a Chinese lake….Nuremberg trials re-established the principle that waging aggressive war was a criminal act….

[This] New World Order…[made] international wars…less imaginable…inadvertently made possible more ‘intranational’…civil wars or brutal insurgencies….Well-meaning but ill-conceived wars to change odious regimes have sometimes gone badly wrong…[but] great powers no longer fight each other….

[Since] liberal order of the past 70 years [was]…better than any of the alternatives…[there’s] alarm that the…consensus on the illegality of war is under siege…[by] jihadism; an angry Russia and an ambitious China…Iranian support for terrorist groups; and North Korea’s contemptuous [refusal]…to rein in its nuclear program….

[But] greatest danger at present is…American president who despises international norms, who disparages free trade and…continually flirts with abandoning America’s essential role.” https://www.economist.com/news/books-and-arts/21729415-it-was-underpinned-movement-make-waging-aggressive-war-illegal-and

Learning effects, network effects, and runaway leaders -

“[A] new economic force at work in the machine learning…[as] learning effects: the more a product learns, the more valuable it becomes…[if] able to close this loop and make it self-reinforcing…[so] more valuable products attract more users or customers, who provide more and richer data of the kind that enables machine learning models to make these products more valuable still, which attracts more users….

Just as network effects determined…winners of the internet revolution…learning effects will determine who the biggest winners of the machine learning revolution….

In the offline world, learning effects are transmitted through humans…[but] is artisanal, and…only scales so quickly….[I]n the machine learning…certain kinds of learning have become automated…[thereby] unlocking of new source of economic value….

[Best] example of the power of learning effects is Tesla…[where] rate of innovation and value creation in the autonomous driving area have dwarfed the capabilities of its competitors.

Network effects and learning effects generate growth in different ways. Network effects tend to generate growth organically through a kind of gravitational accretion….Learning effects [result]…of finely tuned technology and product development efforts that require constant intervention and recalibration in order to tie together data, intelligence, product innovation and user/customer growth….

[Still] value must be strong enough and productized well enough to attract more customers. Any break in this chain means there is no self-reinforcing cycle and hence no learning effects….

[T]o produce runaway leaders [requires]…definitive advantage over…competitors in one of the component areas of learning effects — data, intelligence, product innovation or user/customer growth — and leverage this into advantages…[and] acquire data, learn, innovate and grow not only more rapidly than its competitors do, but more rapidly than they can…. It requires excellent execution…[which] requires that its models be as or more efficient than those of its competitors…then tie to a product innovation advantage… directly correlated with a user or customer acquisition advantage….

Generally the narrower the scope of a product and the greater the degree to which machine learning drives its value, the easier it is to tie these advantages together to create a runaway leader….[T]o maintain their leads over time, there’s an important additional requirement, which is that the learning curves for their products must be long enough and steep enough to enable them to provide increasing product value….

[Some products] have perpetual learning curves…[like] search, semantic engines, adaptive autonomous systems and applications requiring a comprehensive real-time understanding of the world….

Network effects almost always create the opportunity for learning effects…[and] learning effects can create network effects….[But] when learning effects create network effects, these network effects do not exist independently of them [as]… expression of the learning effects: learning just happens to take place through a network….The reverse, however, is not true. Network effects can give rise to learning effects that can exist independently of them….

Since network effects and learning effects are both functions of customer value, whenever they exist side by side in a product, they always reinforce each other…[and] run away from the pack much faster and are generally impossible to catch….

There are huge new datasets and data-rich applications created every day…in domains where [big]…platforms have little or no presence….

Only by constantly tightening and amplifying these loops can companies grow rapidly from learning effects and hope to achieve escape velocity to become runaway leaders. As a general rule, startups tend to be better at this than incumbents.”

https://techcrunch.com/2017/09/21/learning-effects-network-effects-and-runaway-leaders/

Find more of my ideas on Medium at, A Passion to Evolve.

Or click the Follow button below to add me to your feed.

Prefer a weekly email newsletter — no ads, no spam, & never sell the list — email me dochuston1@gmail.com with “add me” in the subject line.

May you live long and prosper!

Doc Huston