News — At The Edge — 11/2

A growing global population under age 24, mixed with declining economic opportunities from political policies favoring the rich — 41% under 24, money vs. health, inequality, IPOs, food & cryptocurrency — portends big trouble as economic dislocation continues to spread.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

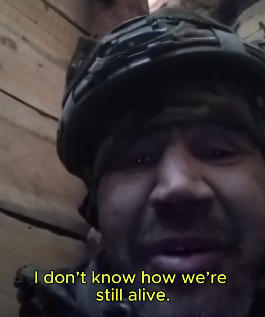

About 41% of the global population are under 24. And they’re angry… -

“From Hong Kong to Chile, young people are rising up to fight injustice and inequality…[and] fueling a search for common denominators and collective causes….

In Africa, 41% is under 15. In Asia and Latin America (where 65% of…people live), it’s 25%. In developed countries…16% of Europeans are under 15, about 18%…are over 65….

[Most] reached…adulthood in a world scarred by…2008 financial crash…[with] falling living standards, and austerity programs…from on high…shaped their experience. As a result, many current protests are rooted in shared grievances about economic inequality and jobs…[and] is producing political timebombs.

Each month in India, one million people turn 18 and can register to vote. In the Middle East and North Africa, an estimated 27 million youngsters will enter the workforce in the next five years.

Any government, elected or not, that fails to provide jobs, decent wages and housing faces big trouble…[because] they’re connected…[and] access to education…are healthier…less bound by social conventions and religion…expectations are higher…[and] are more open to alternative life choices, more attuned to ‘universal’ rights and norms such as free speech or a living wage — and less prepared to accept their denial.

Political unrest deriving from such rapid social evolution is everywhere…[with] increased willingness of undemocratic regimes, ruling elites and wealthy oligarchies to use force to crush threats to their power — while hypocritically condemning protester violence.

Repression is often justified in the name of fighting terrorism…[and] growing readiness of democratically elected governments, notably in the US…to lie, manipulate and disinform.” https://www.theguardian.com/world/2019/oct/26/young-people-predisposed-shake-up-established-order-protest

How to reveal a country’s sense, over the years, of its own well-being —

“[Claim’s] a country’s inhabitants get happier as it gets richer…[yet] long-term evidence [lacking]…[after] examining millions of books and newspaper articles published since 1820 in four countries (America, Britain, Germany and Italy)….

[New] objective measure of each place’s historical happiness…[shows] wealth does bring happiness, but some other things bring more of it…[in] National Valence Index…[as] reflecting important events….

[America’s] happiness fell during the world wars…[and] in the 1860s, during and after the country’s civil war…[but] lowest point…1975, at the end of…Vietnam war…[and] humiliating defeat….[The] boom of the 1920s…lifted American spirits…[but] fell again in the Great Depression….After the…[1970s] happiness…has been on the rise….

[So] happiness does vary with GDP…[but] effect of health and life expectancy [larger]….

A one-year increase in longevity, for example, has the same effect on national happiness as a 4.3% increase in GDP…[and] warfare that causes the biggest drops in happiness.

On average it takes a 30% increase in GDP to raise happiness by the amount that a year of war causes it to fall….

[So] increasing national income is important to happiness…[but] not as important as ensuring the population is healthy and avoiding conflict.” https://www.economist.com/science-and-technology/2019/10/17/how-to-reveal-a-countrys-sense-over-the-years-of-its-own-well-being

*****

In the past, America was not as unequal as it has become —

“[Historically] America has been a more egalitarian place than Europe…[excluding] slavery….

[1810] richest 10% of Americans controlled less than 60% of national wealth, compared with more than 80% in Europe….Roosevelt’s New Deal finished the work…[so]1950s American economy was…most advanced in the world…[and] bastion of egalitarianism….

From 1979 to 2016…income of the top 1% of Americans grew by…225%, compared with…41% for the middle-class…[so] share of the country’s wealth controlled by…top 0.1% more than doubled, to 20%. In continental Europe…income earned by the richest 1%…increased by two percentage points over the past 40 years, compared with ten percentage points in America.

Political momentum is building for a response….Analysis tends to focus on…globalization or…impact of technology on [jobs]…[but] policy has exacerbated…economic pressures…[especially] taxation in America has become less progressive over the past four decades.

In the 1970s the rich paid twice as much in tax, as a share of their income, as the working poor…[but] richest Americans…[paid] rate of about 23% of income in 2018…[but] low-income Americans paid roughly 25%…at a time of extraordinary growth….

The rich try to avoid tax, then win concessions from politicians who argue…attempts to get more from the wealthy are doomed….[This] foundered in the past…because of a shared…value of collective [action]….

[Others] blame…slow corruption of American meritocracy, which has ossified into a formidable caste system…[and] gap in academic achievement between the children of rich and poor families is now larger than that between black and white pupils in the era of segregation….

[So] conditions into which children are born drastically influence their economic prospects as adults….[Need] better access to pre- and post-natal health care…improved access to early childhood education…[with] high-quality pre-kindergarten programs….

Higher wages…[and] more predictable work schedules, could narrow the gap…[plus] zoning reforms or subsidies that encourage migration to thriving areas could loosen up…class-bound hierarchy….

[Since] highly unequal economies seem to rely more on credit booms to propel growth, redistributing income from rich to poor would make the economy less crisis-prone.

Raising American test scores to the average across developed economies would boost output by an estimated $2.5trn — or 12% of 2017 GDP — over the next 35 years….

[Unfortunately] the power to implement change rests with the winners…[as] the rich receive more legislative attention…[as] political spending by the rich has risen alongside inequality, as has political polarization; the resulting dysfunction suits the wealthy….

[Today] winners feel they deserve their spoils, while losers are asked to accept their fate. Restoring dignity to workers…could prove uncomfortable.” https://www.economist.com/books-and-arts/2019/10/24/in-the-past-america-was-not-as-unequal-as-it-has-become

IPOs are a racket. But try finding something better —

“American IPO model has conquered the world…despite a sometimes tawdry reputation…[like] dotcom boom…when deliberately underpriced IPOs rocketed on their first day of trading, bankers doled out ‘hot’ IPOs to executives in exchange for underwriting business, and new shares were ‘spun’ and ‘flipped’ for profit….

Scrutiny of IPOs is long overdue…[as] a classic case of cronyism. Even fans… call them ‘legalized bribery’….

[T]rick is to find an IPO price that satisfies the company but also stimulates buying…on the first day of trading…[though] represents money left on the table that…belong to the company’s sellers…a whopping $39bn…or about 14% of the total sum raised….Money managers pay higher trading commissions, or ‘soft dollars’…in exchange for access to the hottest listings…[making] IPOs look like a racket…[since] sellers usually pocket such a windfall from an IPO….

[Still] firms have two more ways of going public. Auctioning shares to the highest bidders, as Google did in 2004, or selling shares directly without underwriters and without raising capital, a route taken recently by Spotify….

[But] auctions are unpopular [globally]….Direct listings are now creating a buzz…because they already have lots of cash on their balance-sheets and…no need to raise more…not require an underwriter, so are cheaper, and allow the sale of piles of shares quickly. Investors are attracted by higher levels of liquidity than in an IPO. Banks are less keen….But it has never been easy to value companies.” https://www.economist.com/business/2019/10/24/ipos-are-a-racket-but-try-finding-something-better

*****

Nutritious foods have lower environmental impact than unhealthy foods —

“’[I]f a food product is good for one aspect of a person’s health, it’s better for other health outcomes, as well…[and] same holds for environmental outcomes’….

[So] foods associated with improved health outcomes (e.g., whole grain cereals, fruits, vegetables, legumes, nuts and olive oil) have the lowest environmental impacts…

[but] foods with the largest increases in disease risks — primarily unprocessed and processed red meat such as pork, beef, mutton and goat — are consistently associated with the largest negative environmental impacts….

[Two] exceptions are fish, a…healthier food with moderate environmental impacts, and sugar-sweetened beverages, which pose health risks but have a low environmental impact….

[Thus] transitioning diets toward greater consumption of healthier foods would also improve environmental sustainability.” https://phys.org/news/2019-10-nutritious-foods-environmental-impact-unhealthy.html

*****

China passes cryptography law as gears up for digital currency —

“[The] new digital currency would bear some similarities to Facebook…Libra coin…[for] major payment platforms such as WeChat and Alipay…‘facilitating the development of the cryptography business and ensuring the security of cyberspace and information’….

Libra will be a digital currency backed by a reserve of real-world assets, including bank deposits and short-term government securities, and held by a network of custodians…to foster trust and stabilize the price… powered and recorded by a blockchain.” https://www.reuters.com/article/us-china-lawmaking/china-passes-cryptography-law-as-gears-up-for-digital-currency-idUSKBN1X600Z

Find more of my ideas on Medium at,

A Passion to Evolve. (and archived at bottom of the page.)

Or click the Follow button below to add me to your feed.

Prefer a weekly email newsletter — free, no ads, no spam, & never sell the list — email me dochuston1@gmail.com with “add me” in the subject line.

May you live long and prosper!

Doc Huston